HOMEBLOG

Here Comes the Sun: Solar at Homeword’s Properties

HERE COMES THE SUN: SOLAR AT HOMEWORD'S PROPERTIES Summer is in full swing, and naturally our thoughts turn to all the ways we benefit from the season’s sunny days. Barbecues, playing on the river, camping and otherwise spending time outdoors come to mind—but, most importantly for our organization, so does solar energy. From Missoula to Malta, Billings to Butte, Homeword makes the most of Montana’s long summer days by harnessing clean, renewable energy with solar technology. Seventeen of Homeword’s 29 multi-family residential properties in Montana generate some of their own power with solar photovoltaic (PV) systems. These systems contain solar panels, inverters and other mechanical hardware to absorb sunlight, converting it directly into electricity. It does not produce harmful emissions or pollutants, so its use can significantly reduce carbon emissions that contribute to climate change. Altogether, Homeword’s solar arrays can produce up to 734 kilowatts in an hour at peak operating conditions, supporting 1,088 homes in 10 different Montana communities. According to the U.S. Energy Information Administration, the average U.S. household uses about 30kWh per day. That means our solar generating power could potentially provide all the electricity needed for more than 24 homes. The first solar array we included in a development project was at Gold Dust in Missoula in 2003. At that time, the architects hadn’t yet embraced the good looks of a roof-mounted solar system, so the panels were installed flat on the roof so that they couldn’t be seen from the street. Everyone quickly realized [...]

Jason’s Resident Success Story

JASON'S RESIDENT SUCCESS STORY Jason Davies doesn’t let anything slow him down, thriving while living with disabilities from a childhood stroke. Wearing a bright red cape and S insignia, he is known around Homeword’s Orchard Gardens property where he lives and broader Missoula community by his nickname, “Superman.” Jason was born in Montana and later moved to Spokane, Washington, where he was married for 10 years. He and his wife moved around a lot, and for a while they lived in a dark basement apartment. The lack of light took a toll on his mental health, and he was rarely able to ride his bike where they lived. After getting a divorce, Jason finally decided to leave Spokane. His mom and stepdad rented a U-Haul and helped him move back to Montana and closer to their home in Tarkio. With help from his family filling out the application, a few months later he moved into a rental home at Orchard Gardens in Missoula. “I was very excited,” said Jason. “I was nervous, but I decided I was going to live on my own.” It was at Orchard Gardens that Jason began to embrace his superhero alter ego. Jason has now lived at Orchard Gardens for nine years. His first apartment home was on the upper level, but he has since moved to the main level where he has access to a patio. The apartment home provides plenty of space for Jason and his cat and dog, and light pours [...]

Blue Heron Place Permanent Supportive Housing Serves as Statewide Model

BLUE HERON PLACE PERMANENT SUPPORTIVE HOUSING SERVES AS STATEWIDE MODEL In September, Homeword and partner Missoula Housing Authority (MHA) opened Blue Heron Place to Missoula’s long-term unhoused neighbors. These apartments are Permanent Supportive Housing (PSH), a proven solution for ending chronic homelessness that combines intensive case management and supportive services. The first of its kind in Missoula to offer on-site wrap-around services, Blue Heron Place is making ripples statewide as organizations across Montana take notice. When Homeword began exploring the possibility of creating PSH with on-site services, their staff toured two different examples of PSH in Colorado. They visited Redtail Ponds in Fort Collins and Arroyo Village in Denver and talked with developers, staff and service providers. Homeword incorporated best practices and lessons learned into its work creating Blue Heron Place. Now Homeword is paying it forward by sharing best practices and lessons learned from Blue Heron Place. It serves as the model in Homeword’s development of Baatz Block Apartments with NeighborWorks Great Falls and for other organizations in Montana interested in developing PSH. Recently, Kellie McBride of the Lewis and Clark County Criminal Justice Coordinating Council (CJCC) in Helena reached out to Homeword to learn more about Blue Heron Place and the adjacent Navigation Center. “We want to see what other communities have done,” said McBride. McBride served as the executive director of the YWCA in Helena for seven years, overseeing a major renovation to the organization’s building. In 2017, McBride took on a new position as director [...]

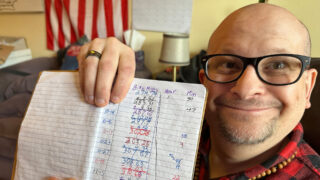

Urban Farm Grows Thousands of Pounds of Food at Homeword Property

URBAN FARM GROWS THOUSANDS OF POUNDS OF PRODUCE AT HOMEWORD PROPERTY Homeword’s Orchard Gardens property is situated on 4.6 acres near the urban-rural fringe of the west side of Missoula, an area still deeply rooted in agricultural traditions. Residents began moving into the 35 rental homes at Orchard Gardens in 2005. At the same time, Homeword partnered with fellow local nonprofit Garden City Harvest. Leasing land on the property to Garden City Harvest for a Neighborhood Farm and Community Garden, the two organizations have collaborated to help revive the tradition of producing food for the community through agriculture. Half of Orchard Gardens is dedicated to urban farming and community gardens. The Orchard Gardens Neighborhood Farm is 1.53 acres. It has served over 1,800 people, including 26 community-supported agriculture (CSA) members, and has grown well over 12,500 pounds of food. Garden City Harvest provides local, sustainably grown produce for the community, focusing on Missoulians whose incomes are below living wages. Their Neighborhood Farm at Orchard Gardens supplies the Missoula Food Bank with produce every year in addition to filling weekly CSA boxes. The farm features an orchard with native bee boxes, a seed saving garden, medicinal herb and flower gardens, educational tours for kids including produce samples and a farm stand for residents at which electronic benefit transfer (EBT) cards are accepted. The farm is also home to the greenhouse that grows starts for many of Garden City Harvest’s farms. There are also 12 garden plots available for rent to [...]

5 Quick Tips for Holiday Financial Wellness

5 QUICK TIPS FOR HOLIDAY FINANCIAL WELLNESS The stress of the holiday season can be compounded with many families feeling financially strapped during this time of year as well. According to a recent Forbes survey on American holiday spending, over a third of respondents (36%) anticipate spending more this holiday season than last year. Food and festive meals will be one of Americans’ biggest expenses, according to 51% of respondents. “Buy Now, Pay Later” payment methods are a popular alternative to traditional credit card financing, with 40% of respondents electing to use this method for expenses related to Thanksgiving and 33% expecting to use it for holiday gift shopping. Here are five quick tips from our HomeOwnership Center educators to shoring up your financial foundation to keep it going strong all year long. Review your health insurance and other benefits to make sure you don't need to make changes for the coming year. This will help make sure you can cover any major unexpected illnesses or accidents, protecting your other savings. Review your budget and use it to help set healthy spending boundaries. Regular review will help keep your goals top of mind and make sure you know where your money is going. Protect your emergency funds. Research the best option for holding onto these funds long-term and letting them grow with interest. Keeping these liquid but growing will help in the event you need to use them but also ensure you are not losing ground if you don't [...]

Watch Out for Debt Relief Scams

WATCH OUT FOR DEBT RELIEF SCAMS Watch Out for Debt Relief Scams Debt relief refers to actions taken to reduce or refinance debt to make it easier and quicker for you to repay it. One form of debt relief is to withhold creditor payments while a debt relief company negotiates on your behalf to reduce your overall payments. In this situation, what you owe overall may be reduced, but late or missed payments could damage your credit and lower your score. Debt relief may be the right answer for you, but not all debt relief organizations have good intentions. It’s smart to be aware of the scams out there and know how to spot them. What are debt relief scams? Debt relief scams target consumers who have significant debt by falsely promising that they will help you negotiate with creditors to lower your debt owed. These operations often charge large, up-front fees, and then fail to help you settle or lower your debts – if they provide any service at all. Debt relief scams may even masquerade as special "government" programs, but they are only after one thing…to profit from your vulnerability. What are some common debt relief scam red flags? Robocalls. Robocalls (recorded phone messages) are always “watch out” situations. This is especially true when it comes to unsolicited debt relief services. Upfront payments. Legitimate debt settlement companies should not ask for up-front payments. Tells you to stop communicating with your creditors. When you cut off communication with a [...]